Despite Slowing Rate of Increase in Auto Insurance Pricing, Most Customers Still Shopping, J.D. Power Finds

Despite Slowing Rate of Increase in Auto Insurance Pricing, Most Customers Still Shopping, J.D. Power Finds

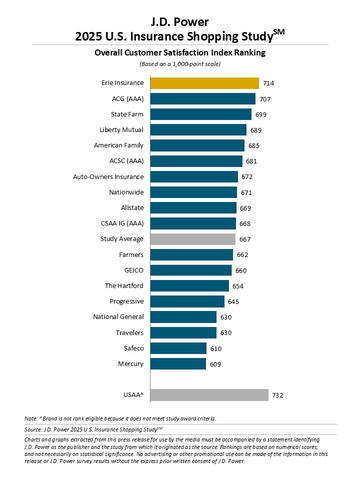

Erie Insurance Ranks Highest in Customer Satisfaction for Second Consecutive Year

TROY, Mich.--(BUSINESS WIRE)--The rate at which auto insurance premiums increased in 2024 declined to less than 2% at year-end from 13% at the beginning of the year. But, even as auto insurance customers in the United States have gained some pricing relief, the percentage of customers shopping for insurance year over year jumped to 57% from 49%, according to the J.D. Power 2025 U.S. Insurance Shopping Study,SM released today.

“Auto insurance rate taking reached multi-decade highs in the first quarter of 2024, which put record numbers of customers into the market shopping for lower-priced policies as the year progressed,” said Stephen Crewdson, managing director of insurance business intelligence at J.D. Power. “As rate activity began to fall in the second half of 2024, many shoppers were successful at finding lower-priced policies. That combination of increased shopping and less rate taking created a bit of a snowball effect for much of the year, but we are seeing signs that shopping rates are starting to normalize. A potentially bigger concern for the industry right now might be the increased interest many consumers are showing in embedded insurance providers, like auto dealers, financing companies and manufacturers.”

Following are some key findings of the 2025 study:

- Insurance price volatility stirs surge in shopping activity: More than half (57%) of auto insurance customers have actively shopped for a new policy in the past year, the highest shopping rate ever recorded in the 19-year history of the study. Shopping rates were higher in Q1 2024, in line with record highs in insurance rates. As price increases slowed throughout the year, shopping rates increased.

- Stickier customers up for grabs: One-third (33%) of customers who are actively shopping for an auto policy are seeking to bundle their auto policy with a homeowner’s policy. Customers who bundle insurance have longer tenures with their insurer (7.0 years on average vs. 5.5 among those who do not bundle), which makes winning these customers a priority for carriers.

- Growing interest in dealer- and manufacturer-provided insurance: More than one-third (37%) of auto insurance customers say they are interested in embedded insurance, a form of auto insurance that is sold directly through the automobile dealer or manufacturer. Interest is highest among Generations Y/Z1 (47%), and among those who say their primary reason for shopping their auto policy is service (48%).

- Usage-based insurance (UBI) sees a small resurgence: More often, insurers are offering UBI programs, which use telematics software to monitor an insured’s driving style and assign rates based on safety and mileage metrics. This year, 17% offered UBI programs to shoppers, up from 15% in 2024 but down from 22% in 2023.

Study Ranking

Erie Insurance ranks highest among large auto insurers in providing a satisfying purchase experience for the second consecutive year, with a score of 714. ACG (AAA) (707) ranks second and State Farm (699) ranks third.

The J.D. Power U.S. Insurance Shopping Study, now in its 19th year, captures advanced insight into each stage of the shopping funnel and is based on responses from 12,720 insurance customers who requested an auto insurance price quote from at least one competitive insurer in the previous six months. The study was fielded from April 2024 through January 2025.

For more information about the U.S. Insurance Shopping Study, visit https://www.jdpower.com/business/resource/jd-power-us-insurance-shopping-study.

See the online press release at http://www.jdpower.com/pr-id/2025038.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business. The J.D. Power auto-shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2006). Millennials (1982-1994) are a subset of Gen Y.

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com